Huntingon’s Minnesota president seeks racial justice through banking role

December 15, 2022

An All-THC Taproom Is Popping Up in Northeast This Weekend

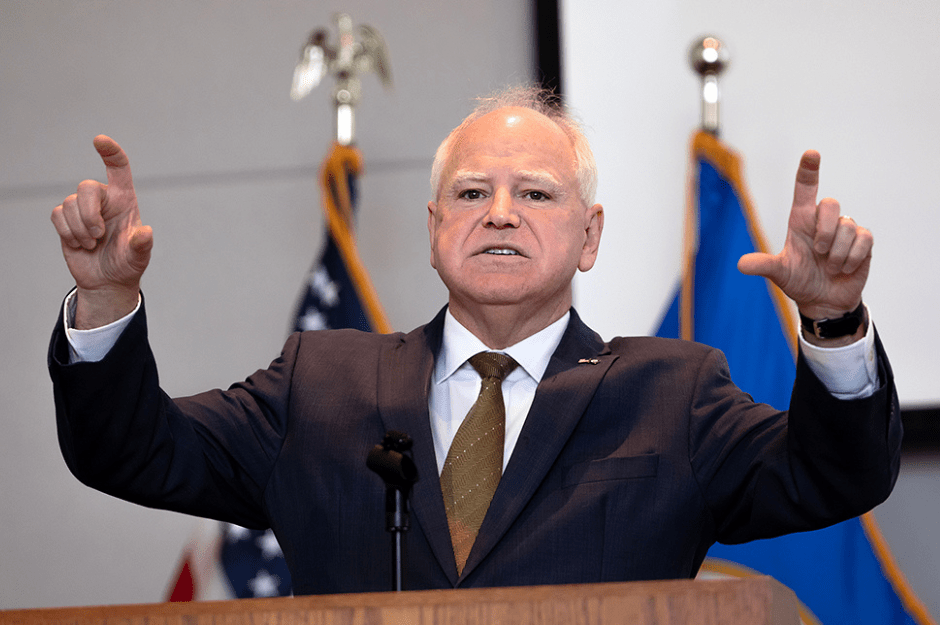

December 15, 2022What’s in a name? For the tax rebate checks dubbed “Walz Checks” by a guy named Walz, the name was a death sentence.

Until it wasn’t.

Before the 2022 legislative session and after a tour of Minneapolis Community and Technical College to highlight his economic development package, the DFL governor expressed his support for what he called “Walz Checks.”

Reminiscent of “Jesse Checks” that former Gov. Jesse Ventura implemented two decades before, the DFL governor proposed using some of a then-record budget surplus to send rebates to taxpayers.

It was not shocking that legislative Republicans, especially those who controlled the Senate, didn’t care for the idea or the name. It was an election year and Republicans were unlikely to let the DFL governor send cash to voters just as they were considering his reelection. There was also some over-confidence at play as Republicans thought they would call all of the shots after the 2022 election and didn’t need to give DFLers any of the glory for tax reductions.

A year later and with that election producing different results than Republicans expected, an idea that a previous House GOP leader called “election-year desperation” is now something the new House GOP leader calls a good idea. Because much of the current $17.6 billion surplus is left over from the current budget and isn’t expected to be sustained in the next, Rep. Lisa Demuth, R-Cold Spring, said uses should be one-offs as well.

“It’s one-time money, so you have to look at possible one-time rebates to our tax filers,” she said. “It’s a discussion we would have as a caucus.”

Earlier this month after hearing about the new-record surplus, Walz renewed his support for rebates, something he’s never waved on.

“It’s no secret that it was received lukewarmly by both chambers and bipartisanly,” Walz said. “But if you want to reduce costs for the short-term and make an impact on families who really need it, it’s one of the most effective ways.

“We’ll propose it again,” Walz said. If lawmakers acted quickly, perhaps combining rebates with the regular act to conform state taxes with federal tax changes, they could be seamlessly blended into state income tax filings and refunds.

The Legislature did not act quickly on most issues when the House was in DFL control and the Senate in GOP control. All issues were linked and all were possible leverage in bargaining. With the so-called DFL trifecta in which the party controls all three pieces of the legislative process, early action is more likely, though not certain. There is no consensus on rebates or the details of any refunds.

Legislative DFLers preferred targeted tax cuts aimed at lower income Minnesotans, at families, at students. Checks didn’t ring any bells. In June, with little chance of a bipartisan tax and spending deal being approved and with the election front of mind, House Speaker Melissa Hortman came around. As a way to put political pressure on the Senate, she and Walz endorsed a special session to dispense checks – now grown from $350 for a couple to $2,000 – the price tag up from $700,000 to $4 billion.

Offering checks to voters/taxpayers was good politics. It polled exceptionally well. It also gave DFLers something to say when high inflation – especially at the gas pump – came up on the trail.

“It is unconscionable to be setting on $7 billion when Minnesotans are trying to make those bill payments,” Walz said. Added Hortman: “Minnesotans are hurting and we need to take action to help them.”

How did she explain her change of heart, if not to campaign politics? Hortman said inflation had persisted longer than economists had projected.

Rebate checks, Walz Checks, whatever they are called, have more life than ever. With the 2023 session just weeks away and with the surplus now at $17.6 billion, $4 billion doesn’t sound like as much money as it did last spring. The new surplus includes about $11.5 billion that reflects past economic activity and tax collections and isn’t expected to continue into the future. That leads policy makers to suggest one-time-only spending rather than program funding that commits the state to keeping the spending in the next budget and the one after that.

Checks fit neatly into one-time spending. And $4 billion is the cost for a program where checks stop with single tax filers with income up to $164,000 a year and couples with income up to $273,470 a year. Lower those caps and the pricetag drops. Walz has said he is open to lowering the qualifying income levels.

At least eight states awarded rebates to taxpayers by mid-summer, none as generous as the Walz proposal. They range from $75 in Idaho to $850 in Maine.

Walz has rationalized calling the checks “Walz Checks” by citing a similar name when they were proposed by former Gov. Jesse Ventura. But “Jesse Checks” of 1999-2001 were christened by legislative observers and residents, not by Ventura.

Call them what you want, Walz said when called out on the name. “Nobody out there gives one dang what they’re called, they just want them in their pocket.” During the summer, when gas prices hovered around $5 a gallon, Walz said, “I’ll tell you what Minnesotans are gonna call them, they’re gonna call them gas checks because that’s how they’re gonna use them.”

Just don’t call them stimulus checks, as they were when they flowed from congressional response to the pandemic in 2020 and 2021. But even though economists doubt a state-only tax rebate would put enough money into the economy to be inflationary themselves, the checks aren’t called stimulus checks just in case. Unlike the series of checks that flowed from federal pandemic relief in 2020 and 2021, “Walz Checks” aren’t supposed to stimulate an economy that remains overstimulated according to the federal reserve.

“Rebate checks would definitely affect Minnesota’s economy as households spent the money, but it wouldn’t affect national inflation trends,” wrote Louis Johnston, a professor of economics at St. John’s University and the College of St. Benedict. Johnston concluded about the impact of returning the entire state surplus to taxpayers.

“Total household spending for the U.S. in 2021 was about $16 trillion, so that’s 17.6 billion relative to 16,000 billion. That’s about 0.1% of the U.S. economy and not enough to affect spending and inflation,” he said.